VERTEX Real Estate Investors is a private equity fund manager specialized in the Mexican Real Estate Sector.

The VERTEX local executives have an accumulated experience of more than 80 years of successful transactions.

Among many projects, they have participated in more than one hundred real estate transactions in Mexico related to assets with value exceeding USD $6.8 billion in all asset classes of the Mexican Real Estate sector in various roles such as builders, developers, private equity investors, lenders, and investment banking advisors with some of the most important companies both Mexican and Global.

FONDOS

CAPITAL

PRIVADO

VERTEX’ executives have been involved in developing

57 shopping centers

25,300 residential units

100 industrial warehouses

32 office buildings

5 land developments

22 hotels

24 financings / restructurings

Through different roles and responsibilities, VERTEX executives have had in their professional careers profound exposure to the diverse asset classes in the Real Estate sector, participating as Partners, Board Members, Directors or Counterparties of many of the main players in the Real Estate sector in Mexico.

One of the shareholders of VERTEX is Mack Real Estate Group (“MREG”), a vertically integrated real estate firm and private equity fund manager whose principals have participated in numerous real estate funds and joint ventures for more than three decades.

We invest VERTEX equity hand in hand with our investors’ equity, ensuring that all interests and incentives are aligned. We wouldn’t invest our investors equity if we weren’t to put our own equity.

We see the Real Estate business as a whole and focus in making investments that adequately balance the risk/return for our investors.

Business Focus

Our accumulated experience adds up to USD $6.8 billion of completed Real Estate transactions, in addition to hundreds of other transactions that have been analyzed.

The experience of VERTEX' executives has been forged from brick and mortar, beginning their careers in the general contractor and development sectors and then migrating to finance and private equity, through two Real Estate cycles, which has generated a profound understanding of the complete spectrum to successfully invest in Real Estate.

Experience

At VERTEX we do not believe in cutting corners. We are convinced that there is only one way to do things:

Study with analytical rigor all the available ethical possibilities to devise a strategy that maximizes the value of our investments

Analytical Rigor

VERTEX is integrated by a team with a solid professional background with decades of

experience in the Mexican Real Estate sector. All of the executives at Vertex have post-graduate degrees from the best international universities.

The business network that VERTEX has generated during the past 25 years is key to integrate solid and robust teams capable of creating value in our investments.

Professional Sophistication

Innovation is what differentiates and makes outstanding investors.

At VERTEX we search for and generate investment alternatives analyzing all possible business angles to give unique and creative solutions for the projects we invest in.

We structure investments in the form of equity, preferred equity, mezzanine debt, or a combination of these, addressing the particular risks of each alternative, always offering the highest flexibility to our partners and investors, while minimizing risks and maximizing returns.

Innovation

Trust is key in all long term business relationships. VERTEX operates in compliance with the highest standards of institutional transparency and accountability.

We are always on the same side as our investors, always avoiding conflicts of interest.

Institutional Transparency

Business Focus

Experience

Analytical Rigor

Professional Sophistication

Innovation

Institutional Transparency

At Vertex Real Estate Investors (VERTEX) we share a passion to create value for our investors based in the following principles:

Ricardo Zúñiga

Héctor Sosa

Partner and CEO

• More than 25 years of experience in the Real Estate sector, having participated in transactions related to assets with value that exceeded USD $2.3 billion.

• Experience as investor having directed the fund or its investments in Mexico for 6 private equity funds specialized in Real Estate, including Hines Emerging Markets Real Estate Funds I & II, The Peabody Funds and O’Connor Capital Partners.

• Vast experience as developer and general contractor in companies like Hines, BCBA Impulse and Hardin Construction Group.

• Has been board member of several companies including DeMet, GAcción, BCBA Impulse and the Joint Ventures of O’Connor Capital Partners in Mexico including ARA and Aryba.

• Currently board member of Fidelity National Title Mexico.

• Holds a B. S. in Civil Engineering from Universidad Iberoamericana in Mexico City and an MBA from the Wharton School of Business in Philadelphia.

Partner

• 21 years of experience in the construction and Real Estate sector, having participated in transactions related to assets with added value that exceeded USD $1.3 billion. 3 years of experience in the FMCG industry.

• Experience as investor having worked on or directed investments in 4 private equity funds specialized in Real Estate, including The Peabody Funds and O’Connor Capital Partners.

• Experience as COO and Business Development at Hardin Construction Group, where he led the Mexico office.

• Graduated with honors from Universidad Iberoamericana, from where he holds a B. S. in Civil Engineering. Holds an MBA from the University of Texas at Austin.

On March 14, 2011, the listing of the Certificates of Development Capital (Certificados de Capital de Desarrollo or CCD’s or CKD’s) of VERTEX Real Estate FUND I took place.

This fund raised MXP $1,671m to be invested in all of the Real Estate asset classes in Mexico.

VERTEX FUND I was the first multi-asset class Real Estate private equity fund in Mexico, where Mexican institutional investors came together, including highly regarded domestic pension funds (AFORES) and insurance companies operating in the country.

Through this first fund, VERTEX invested in 8 projects: 2 in the Luxury Hotels sector, 5 in the Residential sector and 1 in the Retail sector.

Following is a list of the investments of VERTEX FUND I:

THE CAPE HOTEL

Los Cabos, Mexico.

The Cape, a lifestyle-luxury hotel with 161 keys, is a project that included the acquisition of a beach-front lot, the appointment of a prestigious hotel chain, the selection of a Developer, as well as the selection of the Architect (Javier Sánchez de Isa) and Interior Designers (AInteriores owned by Marisabel Gómez Vázquez) and, finally, the integration of the Hotel’s Food & Beverages program of world-acclaimed chef Enrique Olvera.

Since the opening to the public in July 2015, the Hotel has been acknowledged by such editions like Forbes Magazine and Condé Nast Traveler, and has remained a preferred location on Trip Advisor.

Includes some of the top retail anchors in Mexico and is located in a densely populated area in need of new commercial options.

Centenario Shopping Center

Mexico City.

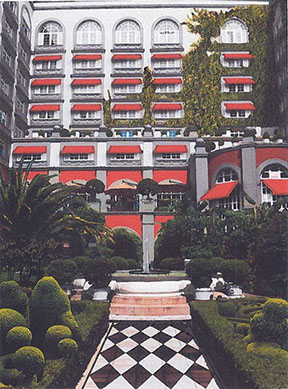

Four Seasons Hotel

Mexico City.

Acquisition of the Four Seasons Hotel Mexico City. A 240 room, 5-star hotel located in Paseo de la Reforma, one of the most important avenues in the city. It is one of the leading hotels and the only one in Mexico City with a 5-diamond award. The business plan of this investment included a significant refurbishing project and also a relaunch to the market. The plan concluded successfully in 2016.

Vidaltus Residential

Mexico City.

Vidaltus offers approximately 300 middle income condos with excellent amenities at affordable prices.

It is located Eastside of Mexico City, very close to transportation hubs, shopping centers and business districts.

Vista Lomas

Guadalajara, México.

In association with Gerbera Capital, Vista Lomas is a Residential development with approximately 350 condos which include top notch amenities. It is located in the Lomas Altas area, bounded by Guadalajara’s peripheral motorway and very close to the main commercial and business districts.

Vista Magna

Guadalajara, Mexico.

In association with Gerbera Capital, Vista Magna is a 'Residential Plus' development consisting of 42 apartments that offer one of the best views and locations in Guadalajara and include top notch amenities. The complex is designed by the prestigious architect firm Elías Estudio and comprises 2 high end towers in the area called Cumbres.

Maranta

Mexico City.

A joint project with Parque Reforma, this 'Residential Plus' development is located in the high end neighborhood of Vistahermosa, very close to one of the most important corporate areas of the city. Phase I, in which VERTEX FUND I invested includes top notch amenities and more than 60,000 m2 of gardens. The area also allocates 3 18-story towers, with a total of 220 apartments averaging 160 m2 each

EXIT

On December 23, 2015 the Stock Market listing of the Real Estate Certificates emitted by Vertex Real Estate DOS, S.A.P.I. de C.V. took place.

This fund raised MXP $3,046m to be invested in all asset classes of the Mexican Real Estate sector.

The acquisition potential of this second Vertex fund tops MXP $6,000m given its conservative leverage capacity.

Following the same strategy as Vertex Fund I, this second fund seeks to acquire and/or develop retail, office buildings, hotels, residential projects, industrial facilities and mixed-use projects.

Vertex business model is based on partnering with land owners, developers or operating partners in order to carry out joint investments in the best Real Estate properties of the country.

The investors of Vertex Fund II’ certificates issued in the Mexican Stock Exchange are the same as in Fund I, a fact that confirms the trust, satisfaction and commitment to Vertex. Among them, we can find the most prestigious Mexican pension funds (AFORES) and insurance companies.

*Vertex Real Estate Investors es una marca registrada de Vertex Real Estate SAPI de CV